The market tried to rally early, but started selling off around ten o'clock, barely stopping to squeeze, and closing near the lows of the day, in lower volume. A late day rally attempt and the lower volume, took some of the sting, out of the bite, but an already shaky foundation, doesn't need anymore weight on it so soon with poor price action. Tomorrow's Monthly Job's Report will most likely determine direction over the next few days, but be prepared for a potential shake out of this rally attempt and a reversal, otherwise the rally could be done as quickly as it started.

Leading growth stocks took the biggest hit, selling off significantly in higher volume. Many remain within their consolidations and above recent pivot points, but another bad day could lead to failing breakouts and short term consolidations breaking apart, requiring at least a few days to digest and set up again. Long term, leading growth stocks could still fall further without jeopardizing longer term trends. Several stocks did resist the selling pressure, Silica Holdings (SLCA), Lithia Motors (LAD), and Matador Resources (MTDR) added to recent gains, in higher volume.

Today is exactly the type of day traders did not want to see, so soon after a rally attempt. Market was weak, thankfully in lower volume, but barely, with a complete inability to sustain a bounce, and leading growth stocks lagged all day, unable to muster any strength to resist the selling pressure. Traders should be getting stopped out of newer long positions and tightening stops on existing, well behaving positions to protect profits, moving away from or to lower margin levels. Be prepared to buy back, this has all the characteristics of a potential shake out. Most leading growth stocks continue unbroken, and are still in fairly tight recent consolidations ahead of tomorrow's Monthly Job's Report. We should have a better idea of trend, by noon tomorrow, hopefully. Review the trading ideas below and our short ideas list for more short setups and leading growth stock analysis for more long setups.

TRADING IDEAS

Pier 1 Import (PIR) has been lagging the market all year. The stock has been consolidating into the fifty day moving average, in low volume, and slowly rolling over the last few days despite the market rally. A failed rally attempt would bring heavier selling into the stock, potentially trading down to around $16, the next major level of support.

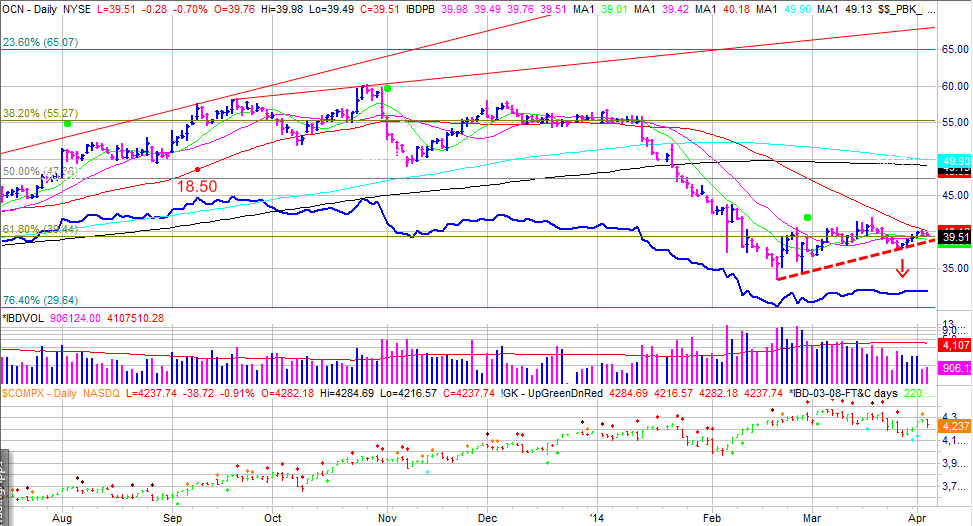

Ocwen Financial (OCN) has been one of bull markets biggest winners, but has acted poorly since breaking down from a head and shoulder pattern at the beginning of the year. The stock has recently paused to digest those losses, pulling back to the fifty moving average in below average volume. The stock has failed to participate in the current rally attempt and looks ready to roll back over to fifty two week lows.

PS: Comments always welcome, even if they disagree. :o)

Leading growth stocks took the biggest hit, selling off significantly in higher volume. Many remain within their consolidations and above recent pivot points, but another bad day could lead to failing breakouts and short term consolidations breaking apart, requiring at least a few days to digest and set up again. Long term, leading growth stocks could still fall further without jeopardizing longer term trends. Several stocks did resist the selling pressure, Silica Holdings (SLCA), Lithia Motors (LAD), and Matador Resources (MTDR) added to recent gains, in higher volume.

Today is exactly the type of day traders did not want to see, so soon after a rally attempt. Market was weak, thankfully in lower volume, but barely, with a complete inability to sustain a bounce, and leading growth stocks lagged all day, unable to muster any strength to resist the selling pressure. Traders should be getting stopped out of newer long positions and tightening stops on existing, well behaving positions to protect profits, moving away from or to lower margin levels. Be prepared to buy back, this has all the characteristics of a potential shake out. Most leading growth stocks continue unbroken, and are still in fairly tight recent consolidations ahead of tomorrow's Monthly Job's Report. We should have a better idea of trend, by noon tomorrow, hopefully. Review the trading ideas below and our short ideas list for more short setups and leading growth stock analysis for more long setups.

TRADING IDEAS

Pier 1 Import (PIR) has been lagging the market all year. The stock has been consolidating into the fifty day moving average, in low volume, and slowly rolling over the last few days despite the market rally. A failed rally attempt would bring heavier selling into the stock, potentially trading down to around $16, the next major level of support.

Ocwen Financial (OCN) has been one of bull markets biggest winners, but has acted poorly since breaking down from a head and shoulder pattern at the beginning of the year. The stock has recently paused to digest those losses, pulling back to the fifty moving average in below average volume. The stock has failed to participate in the current rally attempt and looks ready to roll back over to fifty two week lows.

PS: Comments always welcome, even if they disagree. :o)

No comments:

Post a Comment