As the market bounced around in the morning, leading growth stocks managed to hold, consolidate sideways until the market started to rally firmly around 10:30 EST, and started breaking out of intra-day, day trading patterns, outperforming the market for the first time in over a week, in heavy, above average volume. Most of these stocks are setup or setting up in potential long, short term swing trading patterns, with a few potentially leading to bigger gains if the rally attempt gains steam. Oil stocks, Continental Resources (CLR) followed through on recent strength to new highs, while Concho Resources (CXO) and Silica Holdings (SLCA) are within striking distance.

Short ideas that have broken down and followed through, consolidated their recent gains, but, it would've been preferred that the shorts continued to follow through despite the market's rally attempt, to maintain a higher level of confidence in them. Coal stocks, Alpha Natural Resources (ANR) and Walter Energy (WLT) were the worst squeezed stocks on the short ideas list. Closing up over five percent, in heavy, above average volume.

Aggressive traders should have been initiating a long trade or two, while simultaneously tightening stops on any remaining short positions, just in case the rally attempt gains steam. If not, the initial risk is low, one to three percent, verse the potential profit of five to ten percent. Even during a weak rally attempt.

Otherwise, more conservative investors would be better suited waiting another day or two to see if today's gains hold and follow through. There will be at least one or two shake outs with new setups along the way, if the rally attempt strengthens.

Most setups are off or below moving averages, not near fifty two week highs, which is a sign that the rally attempt has a high probability of being choppy and short lived, and the market's recent history of changing trends on a dime, should keep traders defensive with new positions. Just remember, the earlier breakouts tend to be the easiest to hold, but not the only ones to go on to big gains, and trend changes, whether sudden or slow, are never mentally easy to navigate. The key is always for leading growth stocks to breakout, from short or long term consolidations, and hold above breakout levels during the first few shakeouts. If not, the likelihood of more downside increases dramatically, and traders would be forced to protect themselves from their long positions, and looking for new short trading ideas.

THE SETUPS

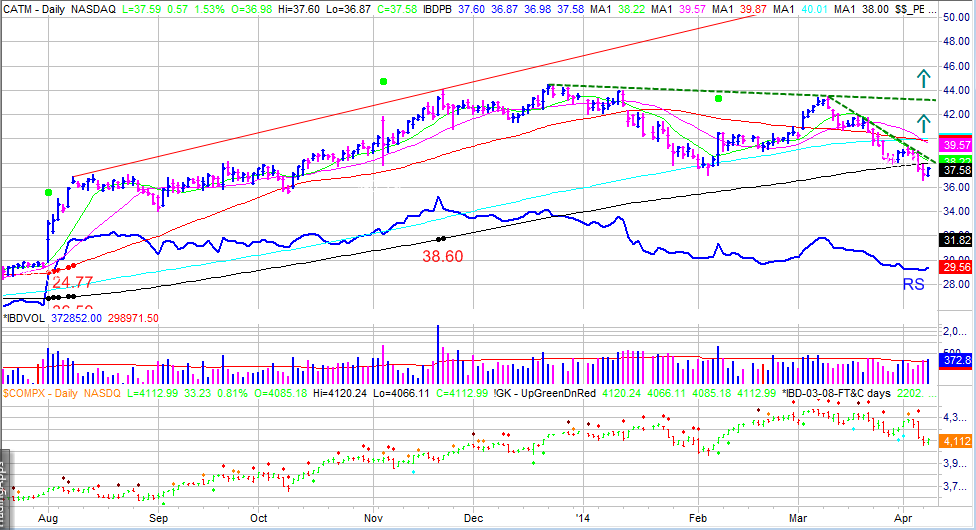

Cardtronics (CATM) rose 50% in just under five months after breaking out of a first stage cup and handle base, in August of 2013, on a positive reaction to an earning's report. The last four months have been spent consolidating those gains, and working on a double bottom base. Look for a breakout above the recent downtrend as the stock climbs up the right side of the double bottom base, or the mid point of the double bottom base, around $43.50. The overall structure and price volume action is very bullish.

NVR (NVR) was the only home builder that broke out and followed through during the last trade able rally. The stock broke out of a one year cup and handle base, in well above average volume, and advanced just short of 20% in a few days. Ever since, the stock has been forming a flat base, digesting those gains in lower volume, as the fifty day moving average catches up. Setting the stage for another run higher. Look for a breakout above the trend line or recent tight range.

Short ideas that have broken down and followed through, consolidated their recent gains, but, it would've been preferred that the shorts continued to follow through despite the market's rally attempt, to maintain a higher level of confidence in them. Coal stocks, Alpha Natural Resources (ANR) and Walter Energy (WLT) were the worst squeezed stocks on the short ideas list. Closing up over five percent, in heavy, above average volume.

Aggressive traders should have been initiating a long trade or two, while simultaneously tightening stops on any remaining short positions, just in case the rally attempt gains steam. If not, the initial risk is low, one to three percent, verse the potential profit of five to ten percent. Even during a weak rally attempt.

Otherwise, more conservative investors would be better suited waiting another day or two to see if today's gains hold and follow through. There will be at least one or two shake outs with new setups along the way, if the rally attempt strengthens.

Most setups are off or below moving averages, not near fifty two week highs, which is a sign that the rally attempt has a high probability of being choppy and short lived, and the market's recent history of changing trends on a dime, should keep traders defensive with new positions. Just remember, the earlier breakouts tend to be the easiest to hold, but not the only ones to go on to big gains, and trend changes, whether sudden or slow, are never mentally easy to navigate. The key is always for leading growth stocks to breakout, from short or long term consolidations, and hold above breakout levels during the first few shakeouts. If not, the likelihood of more downside increases dramatically, and traders would be forced to protect themselves from their long positions, and looking for new short trading ideas.

THE SETUPS

Cardtronics (CATM) rose 50% in just under five months after breaking out of a first stage cup and handle base, in August of 2013, on a positive reaction to an earning's report. The last four months have been spent consolidating those gains, and working on a double bottom base. Look for a breakout above the recent downtrend as the stock climbs up the right side of the double bottom base, or the mid point of the double bottom base, around $43.50. The overall structure and price volume action is very bullish.

NVR (NVR) was the only home builder that broke out and followed through during the last trade able rally. The stock broke out of a one year cup and handle base, in well above average volume, and advanced just short of 20% in a few days. Ever since, the stock has been forming a flat base, digesting those gains in lower volume, as the fifty day moving average catches up. Setting the stage for another run higher. Look for a breakout above the trend line or recent tight range.

No comments:

Post a Comment