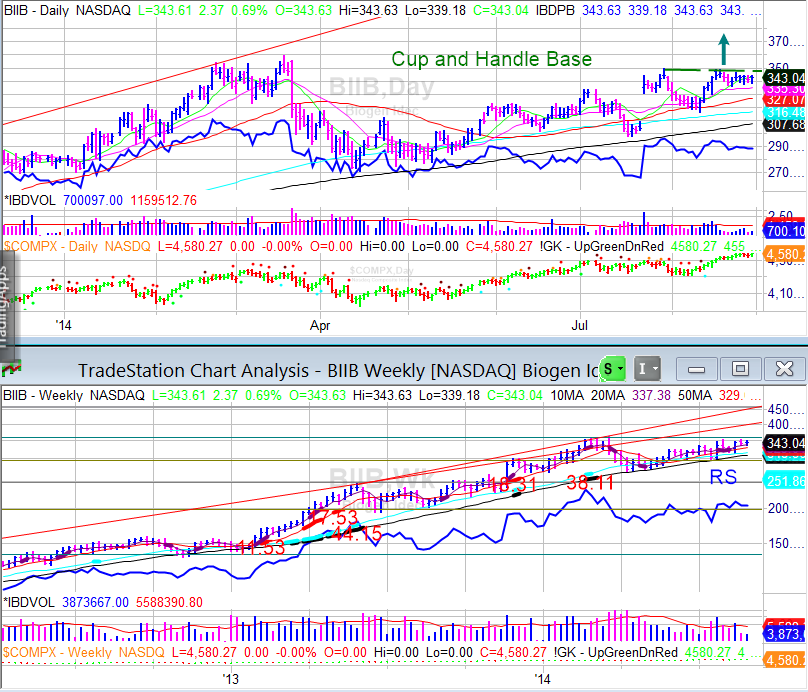

Biogen Idec (BIIB) has advanced over 600% since breaking out of a first stage cup and handle base the week of 10/29/2010. The stocks is currently forming a wide and loose, fifth stage (higher probability of failure), cup and handle base with tighter trading in the handle, in diminishing volume.

Sales growth has accelerated from 6% to 41%, and earnings from 21% to 52%, over the last eight quarters. Over the last three years, sales and earnings growth have averaged 14% and 21%, respectively, and are expected to average 20% and 31% over the next three, respectively. Return on equity has averaged 23%+. The company has beaten analyst's estimates three out of the last four quarters, and by 23% in the last quarter. Year over year sales are expected to decelerate to 9% over the next three years and margins have contracted in the last two quarters, year over year. Possibly two early signs of potential earnings problems to come.

The stock reached its PE expansion price target range of $170 - 200 in early 2013 and has advanced another 100% since. Stocks that exhibit such power have a higher probability of experiencing one final climax run. Based on current valuations, the stock could advance another 20% ($420) in the short run on a breakout above $349, and 40 to 50% ($489 to $525) in a climactic move by year end. Protective stops should be placed around $317 initially, and tightened to $337 if the stock exhibits poor price volume action after the breakout.

The late stage base, decelerating margins and estimated year over year sales growth, significantly increases the risk of failure. Treat the position as a trade, not a long term investment.

Full Disclosure: No Current Position

Sales growth has accelerated from 6% to 41%, and earnings from 21% to 52%, over the last eight quarters. Over the last three years, sales and earnings growth have averaged 14% and 21%, respectively, and are expected to average 20% and 31% over the next three, respectively. Return on equity has averaged 23%+. The company has beaten analyst's estimates three out of the last four quarters, and by 23% in the last quarter. Year over year sales are expected to decelerate to 9% over the next three years and margins have contracted in the last two quarters, year over year. Possibly two early signs of potential earnings problems to come.

The stock reached its PE expansion price target range of $170 - 200 in early 2013 and has advanced another 100% since. Stocks that exhibit such power have a higher probability of experiencing one final climax run. Based on current valuations, the stock could advance another 20% ($420) in the short run on a breakout above $349, and 40 to 50% ($489 to $525) in a climactic move by year end. Protective stops should be placed around $317 initially, and tightened to $337 if the stock exhibits poor price volume action after the breakout.

The late stage base, decelerating margins and estimated year over year sales growth, significantly increases the risk of failure. Treat the position as a trade, not a long term investment.

Full Disclosure: No Current Position

No comments:

Post a Comment